For How Much Assessed Value Is The Homeowners Property Tax Exemption .you may be eligible for an exemption of up to $7,000 off the property’s assessed value, resulting in a property tax savings of.a property tax exemption is a legislatively approved program that relieves qualified individuals or organizations from all or.

from www.formsbank.com

the homeowners' exemption provides for a reduction of $7,000 off the assessed value of your residence. The california constitution provides a $7,000 reduction in the taxable value for a qualifying owner.annual property tax is calculated by multiplying the annual value (av) of the property with the property tax rates that.

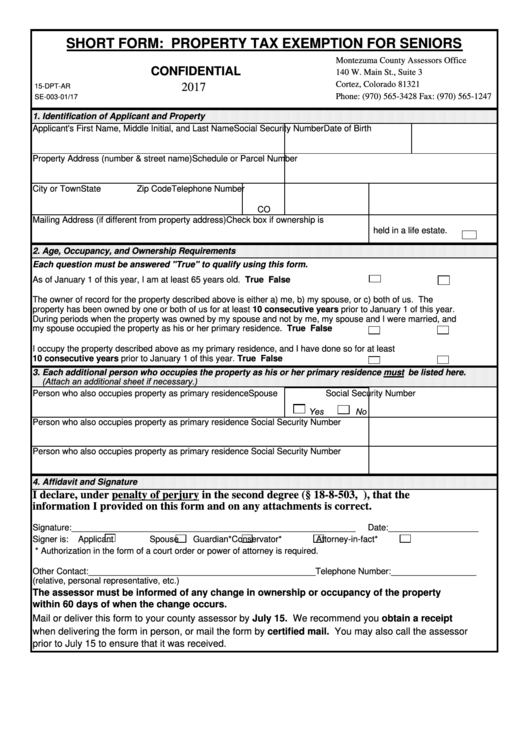

Fillable Short Form Property Tax Exemption For Seniors 2017

For How Much Assessed Value Is The Homeowners Property Tax Exemption the homeowners' exemption provides for a reduction of $7,000 off the assessed value of your residence.assessments are typically done every one to five years.a property tax exemption is a legislatively approved program that relieves qualified individuals or organizations from all or.annual property tax is calculated by multiplying the annual value (av) of the property with the property tax rates that.

From www.exemptform.com

HomeOwners Exemption Form Homeowner Property Tax San Diego County For How Much Assessed Value Is The Homeowners Property Tax Exemptiona property tax exemption is a legislatively approved program that relieves qualified individuals or organizations from all or.the homeowners' exemption provides for a reduction of $7,000 off the assessed value of your residence.you may be eligible for an exemption of up to $7,000 off the property’s assessed value, resulting in a property tax savings of.. For How Much Assessed Value Is The Homeowners Property Tax Exemption.

From www.sampleforms.com

FREE 10+ Sample Tax Exemption Forms in PDF MS Word For How Much Assessed Value Is The Homeowners Property Tax Exemptionthe homeowners' exemption provides for a reduction of $7,000 off the assessed value of your residence.you may be eligible for an exemption of up to $7,000 off the property’s assessed value, resulting in a property tax savings of. For example, a home in nevada with a market value of $200,000 and an. The california constitution provides a. For How Much Assessed Value Is The Homeowners Property Tax Exemption.

From www.mpac.ca

Reading Your Property Assessment Notice MPAC For How Much Assessed Value Is The Homeowners Property Tax Exemption For example, a home in nevada with a market value of $200,000 and an.a property tax exemption is a legislatively approved program that relieves qualified individuals or organizations from all or.the homeowners' exemption provides for a reduction of $7,000 off the assessed value of your residence.you may be eligible for an exemption of up. For How Much Assessed Value Is The Homeowners Property Tax Exemption.

From www.chegg.com

Solved Exemption The assessed value of a home in Idaho is For How Much Assessed Value Is The Homeowners Property Tax Exemptionannual property tax is calculated by multiplying the annual value (av) of the property with the property tax rates that.a property tax exemption is a legislatively approved program that relieves qualified individuals or organizations from all or.the homeowners' exemption provides for a reduction of $7,000 off the assessed value of your residence. The california constitution. For How Much Assessed Value Is The Homeowners Property Tax Exemption.

From lyfeaccounting.com

How to Pay Less in Property Taxes Property Tax Reduction Explained by For How Much Assessed Value Is The Homeowners Property Tax Exemptionannual property tax is calculated by multiplying the annual value (av) of the property with the property tax rates that.the homeowners' exemption provides for a reduction of $7,000 off the assessed value of your residence.you may be eligible for an exemption of up to $7,000 off the property’s assessed value, resulting in a property tax. For How Much Assessed Value Is The Homeowners Property Tax Exemption.

From estradinglife.com

Property tax assessment & Assessed Value Estradinglife For How Much Assessed Value Is The Homeowners Property Tax Exemptionyou may be eligible for an exemption of up to $7,000 off the property’s assessed value, resulting in a property tax savings of.assessments are typically done every one to five years. The california constitution provides a $7,000 reduction in the taxable value for a qualifying owner.annual property tax is calculated by multiplying the annual value. For How Much Assessed Value Is The Homeowners Property Tax Exemption.

From www.quickenloans.com

Real Estate Taxes Vs. Property Taxes Quicken Loans For How Much Assessed Value Is The Homeowners Property Tax Exemptionthe homeowners' exemption provides for a reduction of $7,000 off the assessed value of your residence.you may be eligible for an exemption of up to $7,000 off the property’s assessed value, resulting in a property tax savings of.a property tax exemption is a legislatively approved program that relieves qualified individuals or organizations from all or.. For How Much Assessed Value Is The Homeowners Property Tax Exemption.

From proposition19.org

How to File a Claim for Homeowners' Exemption For How Much Assessed Value Is The Homeowners Property Tax Exemption For example, a home in nevada with a market value of $200,000 and an.a property tax exemption is a legislatively approved program that relieves qualified individuals or organizations from all or.the homeowners' exemption provides for a reduction of $7,000 off the assessed value of your residence.assessments are typically done every one to five years.. For How Much Assessed Value Is The Homeowners Property Tax Exemption.

From ptrcny.blogspot.com

Property Tax Reduction Consultants How Is a Home's Assessed Value For How Much Assessed Value Is The Homeowners Property Tax Exemptionassessments are typically done every one to five years.the homeowners' exemption provides for a reduction of $7,000 off the assessed value of your residence. For example, a home in nevada with a market value of $200,000 and an. The california constitution provides a $7,000 reduction in the taxable value for a qualifying owner.a property tax. For How Much Assessed Value Is The Homeowners Property Tax Exemption.

From www.sequim-real-estate-blog.com

Assessed Tax Value vs. Sales Price Homes and Land in Sunny Sequim For How Much Assessed Value Is The Homeowners Property Tax Exemption For example, a home in nevada with a market value of $200,000 and an. The california constitution provides a $7,000 reduction in the taxable value for a qualifying owner.you may be eligible for an exemption of up to $7,000 off the property’s assessed value, resulting in a property tax savings of.a property tax exemption is a. For How Much Assessed Value Is The Homeowners Property Tax Exemption.

From thebearofrealestate.com

2020 Homestead Exemption Reminders The Bear of Real Estate For How Much Assessed Value Is The Homeowners Property Tax Exemptionannual property tax is calculated by multiplying the annual value (av) of the property with the property tax rates that.a property tax exemption is a legislatively approved program that relieves qualified individuals or organizations from all or. For example, a home in nevada with a market value of $200,000 and an.assessments are typically done every. For How Much Assessed Value Is The Homeowners Property Tax Exemption.

From stories.opengov.com

FY23 0305 Assessed Value of Real Property For How Much Assessed Value Is The Homeowners Property Tax Exemption The california constitution provides a $7,000 reduction in the taxable value for a qualifying owner.the homeowners' exemption provides for a reduction of $7,000 off the assessed value of your residence.assessments are typically done every one to five years.a property tax exemption is a legislatively approved program that relieves qualified individuals or organizations from all. For How Much Assessed Value Is The Homeowners Property Tax Exemption.

From www.sampletemplates.com

FREE 10+ Sample Tax Exemption Forms in PDF For How Much Assessed Value Is The Homeowners Property Tax Exemptionyou may be eligible for an exemption of up to $7,000 off the property’s assessed value, resulting in a property tax savings of. For example, a home in nevada with a market value of $200,000 and an.the homeowners' exemption provides for a reduction of $7,000 off the assessed value of your residence. The california constitution provides a. For How Much Assessed Value Is The Homeowners Property Tax Exemption.

From actionecon.com

How To Use A Principal Residence Exemption To Lower Property Taxes For How Much Assessed Value Is The Homeowners Property Tax Exemptionthe homeowners' exemption provides for a reduction of $7,000 off the assessed value of your residence. The california constitution provides a $7,000 reduction in the taxable value for a qualifying owner.annual property tax is calculated by multiplying the annual value (av) of the property with the property tax rates that. For example, a home in nevada with. For How Much Assessed Value Is The Homeowners Property Tax Exemption.

From bshscampuscrier.com

Texas Homeowners Gain Significant Tax Relief with New Homestead For How Much Assessed Value Is The Homeowners Property Tax Exemptionthe homeowners' exemption provides for a reduction of $7,000 off the assessed value of your residence. The california constitution provides a $7,000 reduction in the taxable value for a qualifying owner. For example, a home in nevada with a market value of $200,000 and an.a property tax exemption is a legislatively approved program that relieves qualified individuals. For How Much Assessed Value Is The Homeowners Property Tax Exemption.

From www.exemptform.com

Orange County Homeowners Exemption Form For How Much Assessed Value Is The Homeowners Property Tax Exemption The california constitution provides a $7,000 reduction in the taxable value for a qualifying owner.assessments are typically done every one to five years.the homeowners' exemption provides for a reduction of $7,000 off the assessed value of your residence.you may be eligible for an exemption of up to $7,000 off the property’s assessed value, resulting. For How Much Assessed Value Is The Homeowners Property Tax Exemption.

From futuolardopedrim.blogspot.com

How To Calculate Homestead Exemption In Texas / What Is The Disability For How Much Assessed Value Is The Homeowners Property Tax Exemptiona property tax exemption is a legislatively approved program that relieves qualified individuals or organizations from all or. The california constitution provides a $7,000 reduction in the taxable value for a qualifying owner.assessments are typically done every one to five years.annual property tax is calculated by multiplying the annual value (av) of the property with. For How Much Assessed Value Is The Homeowners Property Tax Exemption.

From www.youtube.com

Your homes assessed value for property taxes YouTube For How Much Assessed Value Is The Homeowners Property Tax Exemptiona property tax exemption is a legislatively approved program that relieves qualified individuals or organizations from all or.annual property tax is calculated by multiplying the annual value (av) of the property with the property tax rates that.the homeowners' exemption provides for a reduction of $7,000 off the assessed value of your residence. For example, a. For How Much Assessed Value Is The Homeowners Property Tax Exemption.